Secure & scalable software solutions is a must have for every successful lending institutions. The technology product should support diverse geographies, cultural nuances, multi-channel interactions, multi-currency options & even multilingual capabilities. Bankers Realm Core Loan Management Solution does all this and much more.

- Runs on a modern enterprise platform with robust architecture and easy-to-use technology

- Designed for high volume transactions to deliver superior performance

- Seamless integration with the Bankers Realm suite and existing software

- Functions on any browser, adapting to low-bandwidth areas

key features

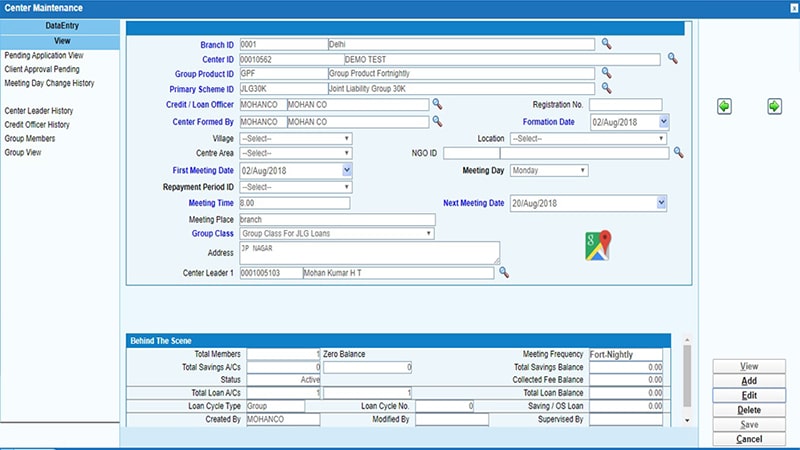

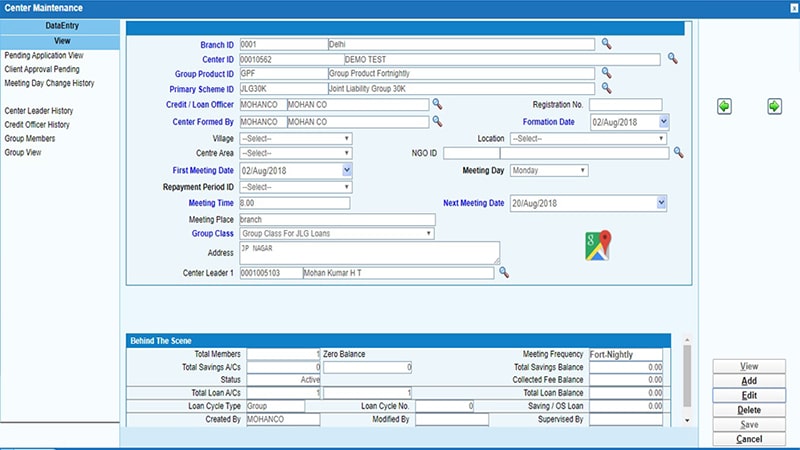

Drives centralized web-based operations with multi-OS support, capable of running even on low-end PCs and mobile phones. The enterprise-class security ensures risk-free integration across industry applications.

- Pre-integrated end to end lending ecosystem

- Built-in compliance to regulatory and statutory requirements

- Parameterized product and process management

- Predictive analytics and dashboarding for all user levels

- Robust financial accounting

- Better adaptability to support customer growth and demography

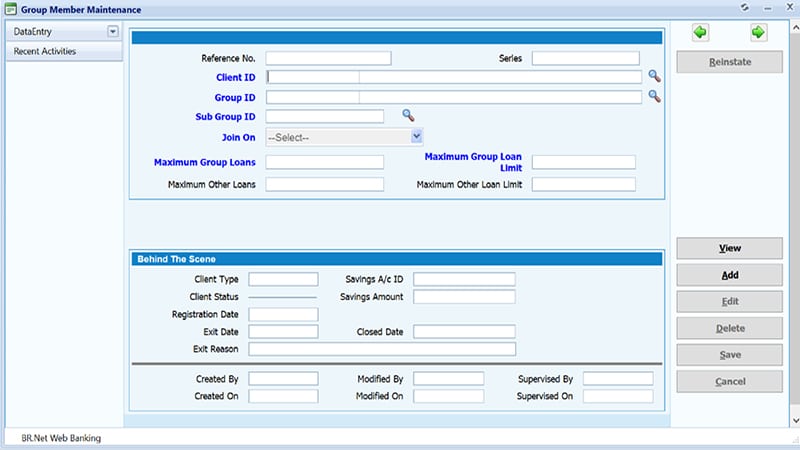

- Supports both Group and Individual loan management

- Secure credit and risk management

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

- Pre-integrated end to end Micro-lending ecosystem

- Built-in compliance to regulatory and statutory requirements

- Parameterized product and process management

- Predictive analytics and dashboarding for all user levels

- Robust financial accounting

- Better adaptability to support customer growth and demography

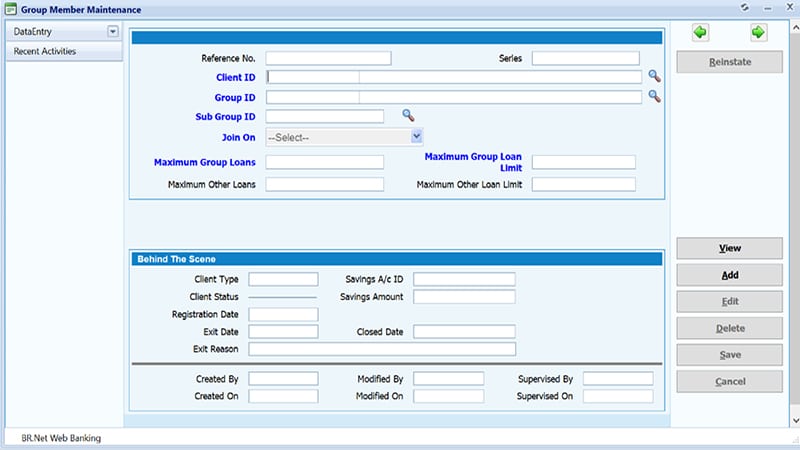

- Supports both Group and Individual loan management

- Secure credit and risk management

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

key benefits

Drive your lending institutions success story with the right technology

Comprehensive data analysis with detailed reports and real time dashboards

Effective for transaction processing and customer relation management

Scalable with efficient interfaces across multiple channels

One stop tech suite for Lending Institutions, driven by agile, secure and flexible technology

BR.Net is an agile, componentized business solution, addressing the needs of:

- Banks,

- SFBs,

- NBFCs and

- MFIs

It works on a robust technology architecture that supports both SaaS & Modern Enterprise Platform. It drives centralized operations, Supports low-end PCs and mobile phones.

The enterprise-class security ensures seamless integration across industry applications and services.

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.

Client Speak

Martin Pampilly

Chief Operating Officer,

Ujjivan Small Finance Bank

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.