MSMEs are crucial for India’s growth, providing employment opportunities, and contributing to both rural and urban industrialization, but they often struggle to obtain credit due to various challenges such as lack of collateral, credit history, financial literacy, delayed manual processes and lower operational efficiency etc. Nimble Business Loan Solution is specifically designed to address these challenges and make lending more accessible, transparent, inclusive and digitized.

With cutting edge technology feat and best in-class features, Nimble Business Loan Technology Solutions offer:

- Cost-efficient systems with enhanced regulatory compliance and better risk management.

- Paperless processing with activity trackers and audit trails

- Seamless customer experience through streamlined operations, reduced risks, and improved efficiency

- Easy loan application procedures, convenient status tracking of applications, and timely disbursements

key features

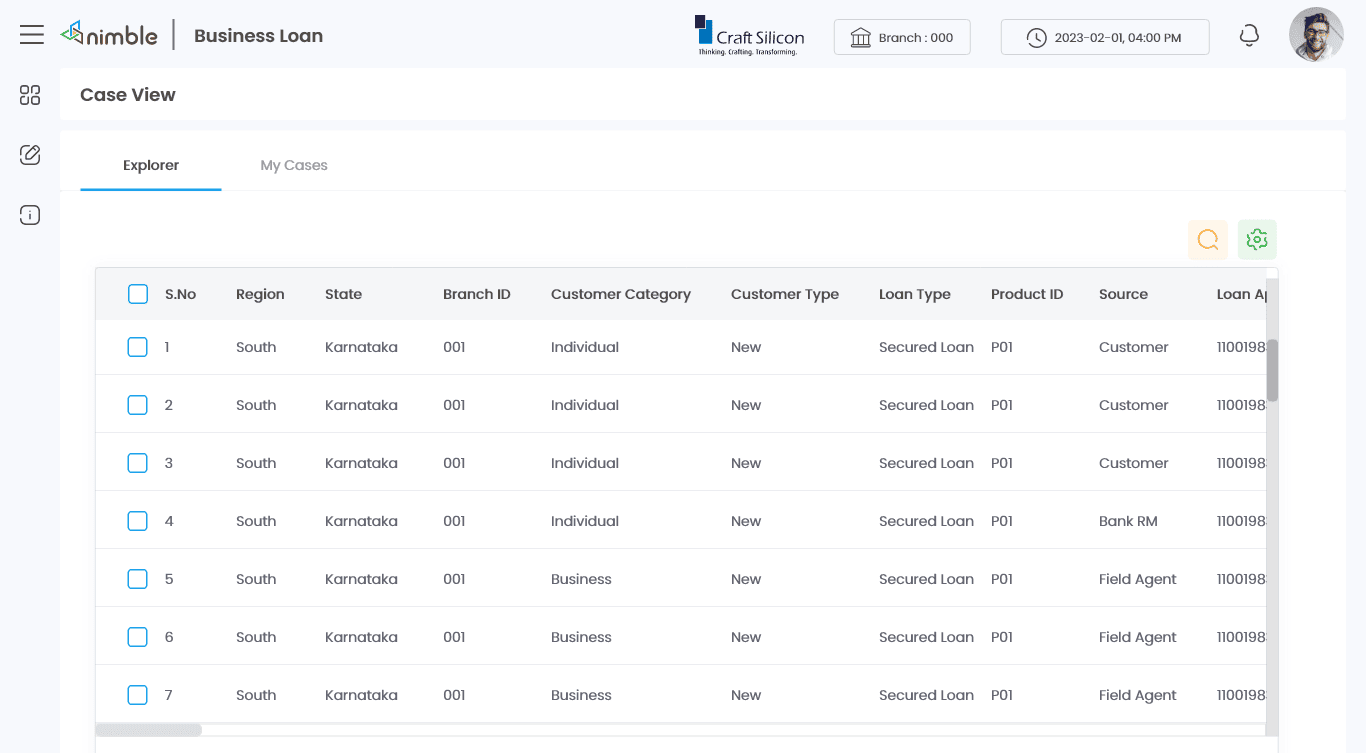

Nimble Business Loan Solution is an automated LOS platform designed to manage the complex proposal evaluation process for the lending needs of Corporate and SME segments. Our robust banking software understands the intricate needs of various lending institutions. Primary functionalities include:

- Modular Architecture

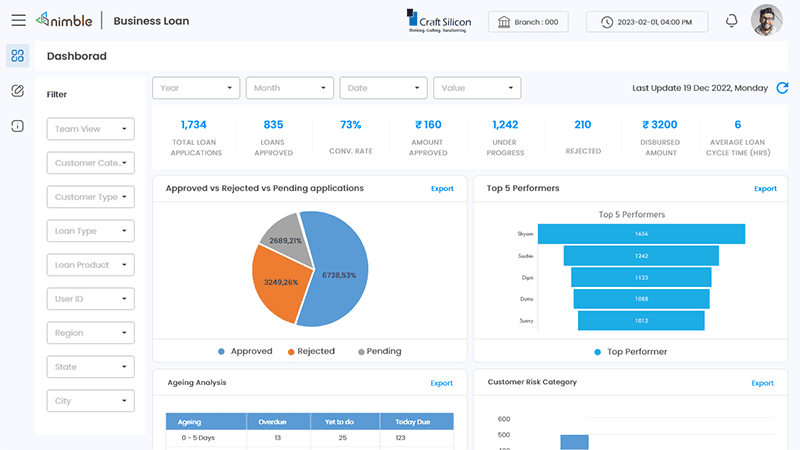

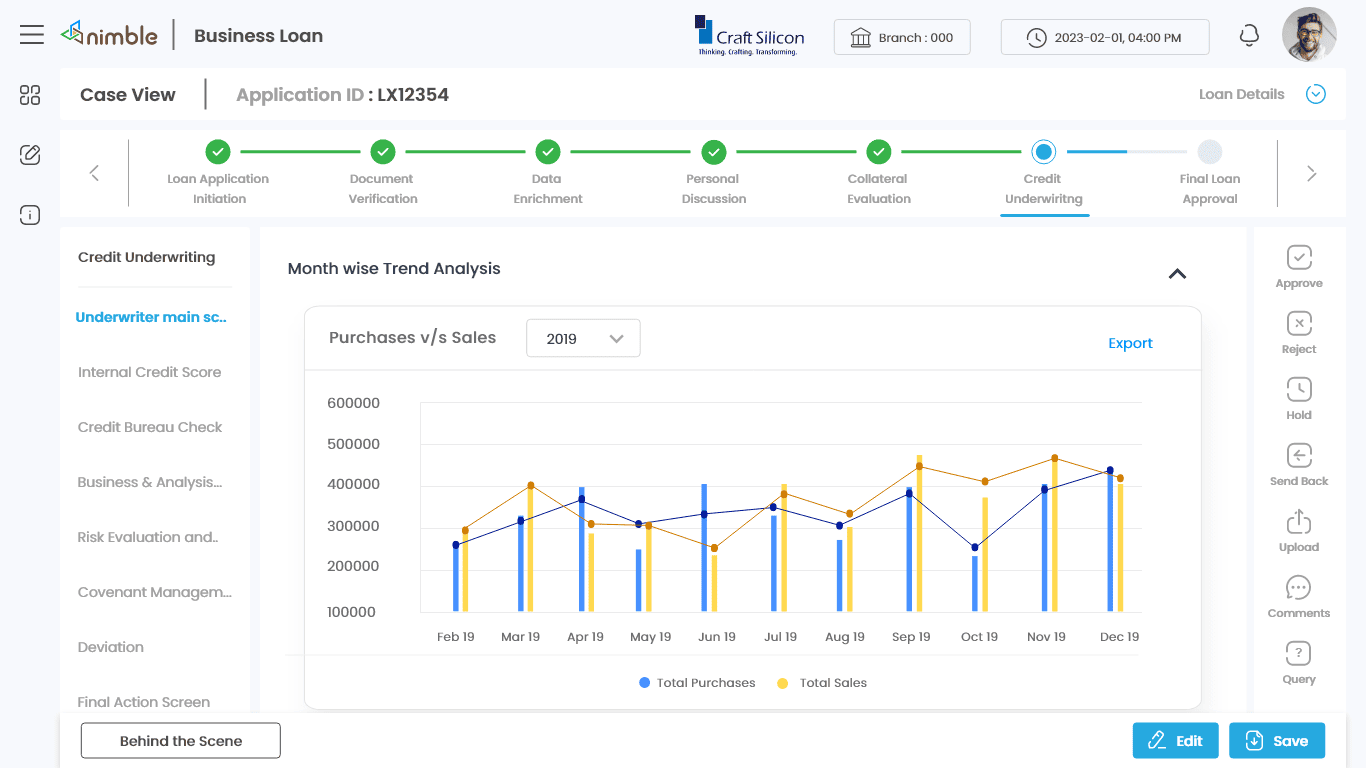

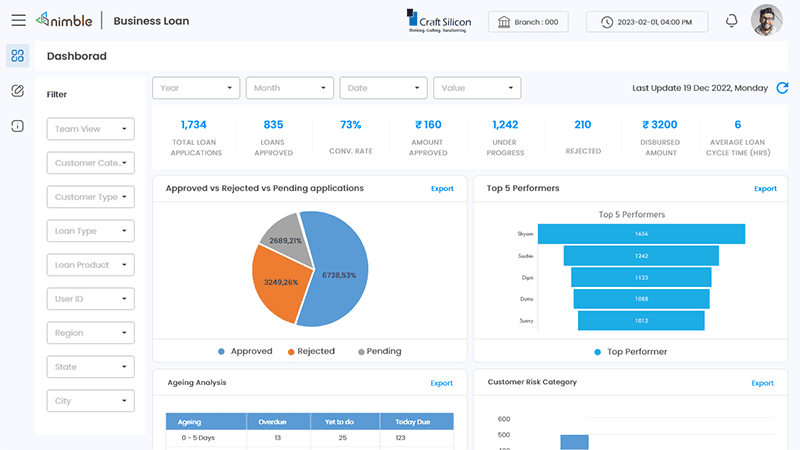

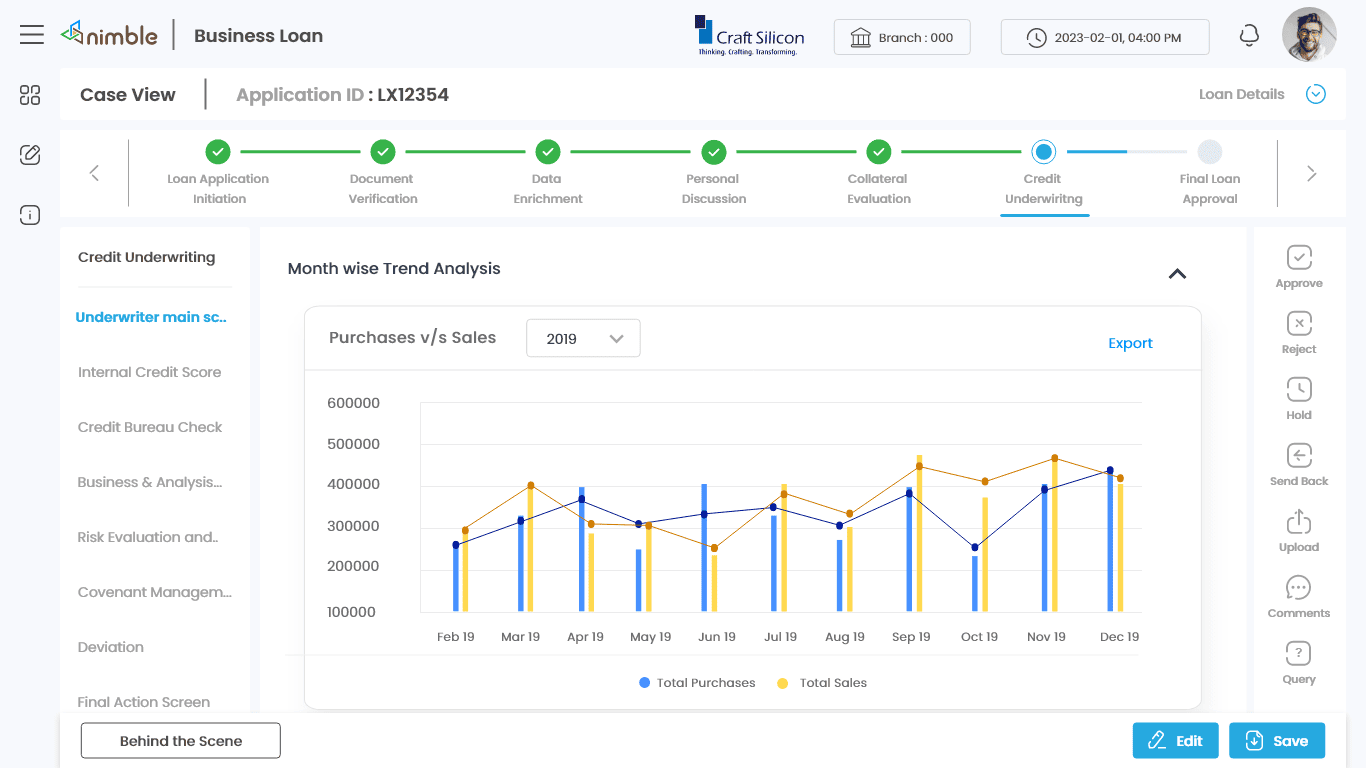

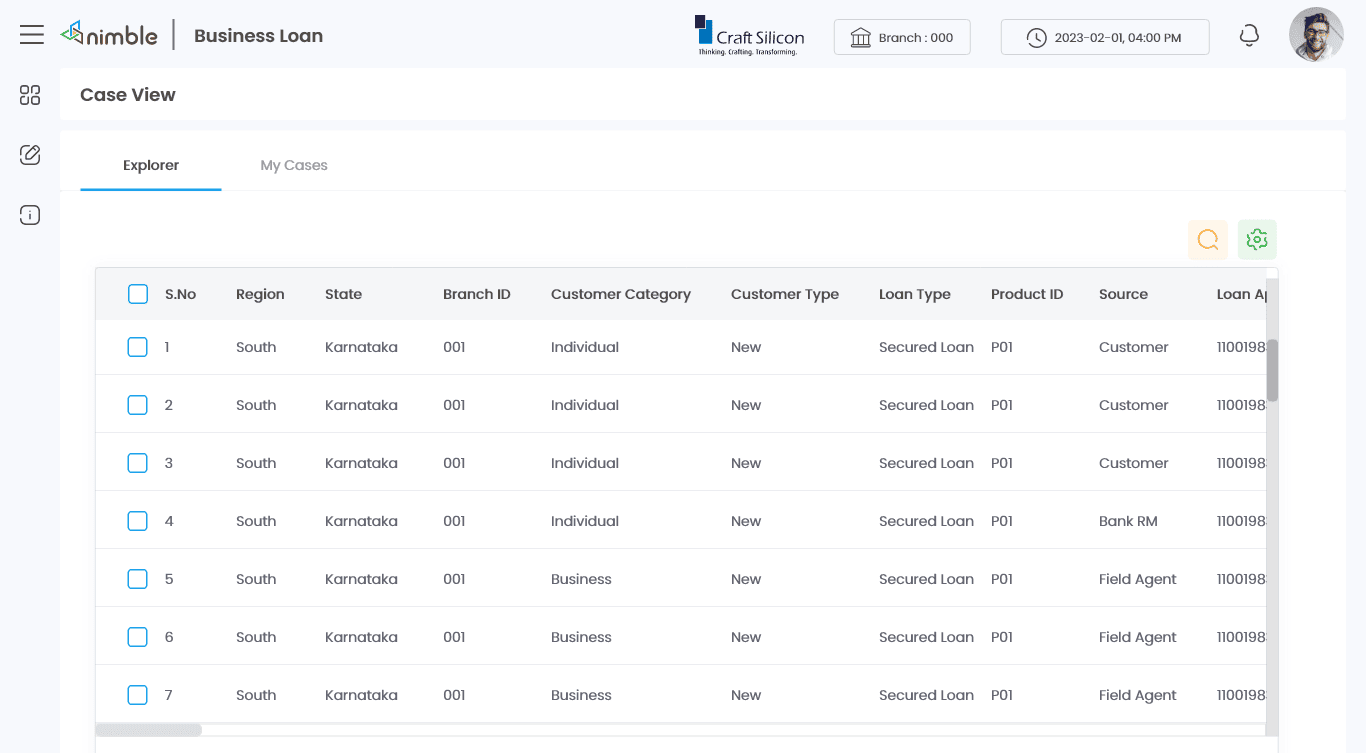

- Configurable Workflows with Dynamic Dashboards

- Business Rule Engine

- Deviation Management

- Credit Committee Approval

- SLA / TAT Management

- Pre-integrated end to end Micro-lending ecosystem

- Built-in compliance to regulatory and statutory requirements

- Parameterized product and process management

- Predictive analytics and dashboarding for all user levels

- Robust financial accounting

- Better adaptability to support customer growth and demography

- Supports both Group and Individual loan management

- Secure credit and risk management

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

- Modular Architecture

- Configurable Workflows with Dynamic Dashboards

- Business Rule Engine

- Deviation Management

- Credit Committee Approval

- SLA / TAT Management

key benefits

Drive your MFI success story with the right technology

Udyam Registration Check

Paperless Processing of Loan

Activity Trackers & Audit Trail

Highly customized as per client requirements

Seamless integration of third-party applications

clients

- The customer app,

- The field agent app and

- The web app

NIMBLE Business Loan Solution from Craft Silicon stands as a testament to the power of technology in transforming the lending landscape.

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.

Client Speak

Martin Pampilly

Chief Operating Officer,

Ujjivan Small Finance Bank

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.