Co-lending is a collaborative lending model where two financial institutions jointly provide financing to borrowers. This approach allows partners to share risks and resources, leading to more diversified lending portfolios and improved access to credit for borrowers.

Co-lending arrangements are often formed to leverage the strengths and resources of each lender, allowing them to reach a broader customer base, share credit risk, and comply with regulatory requirements. There are two co-lending models: CLM 1 and CLM 2, each with distinct disbursement and reimbursement mechanisms. Our co-lending solution can be enabled dynamically for banks and NBFCs depending on their nature of partnership with other institution.

key features

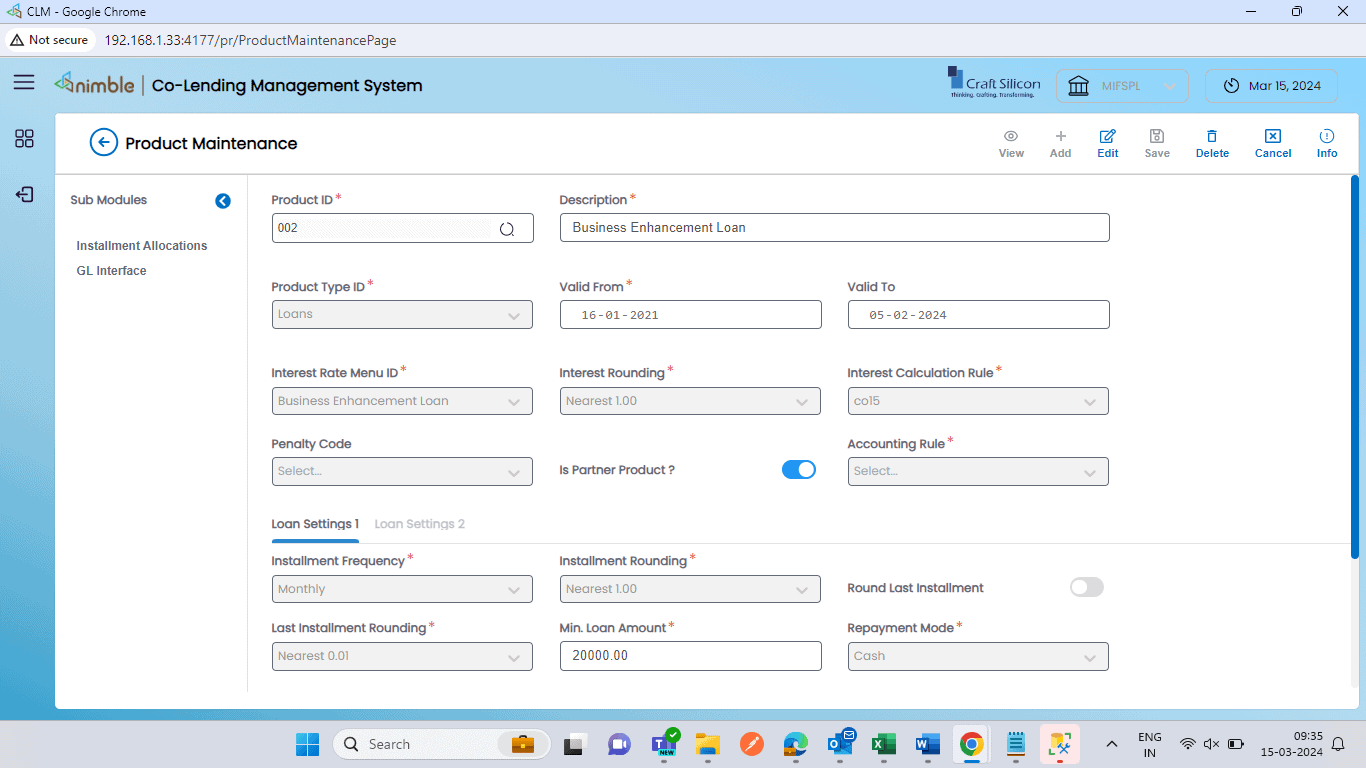

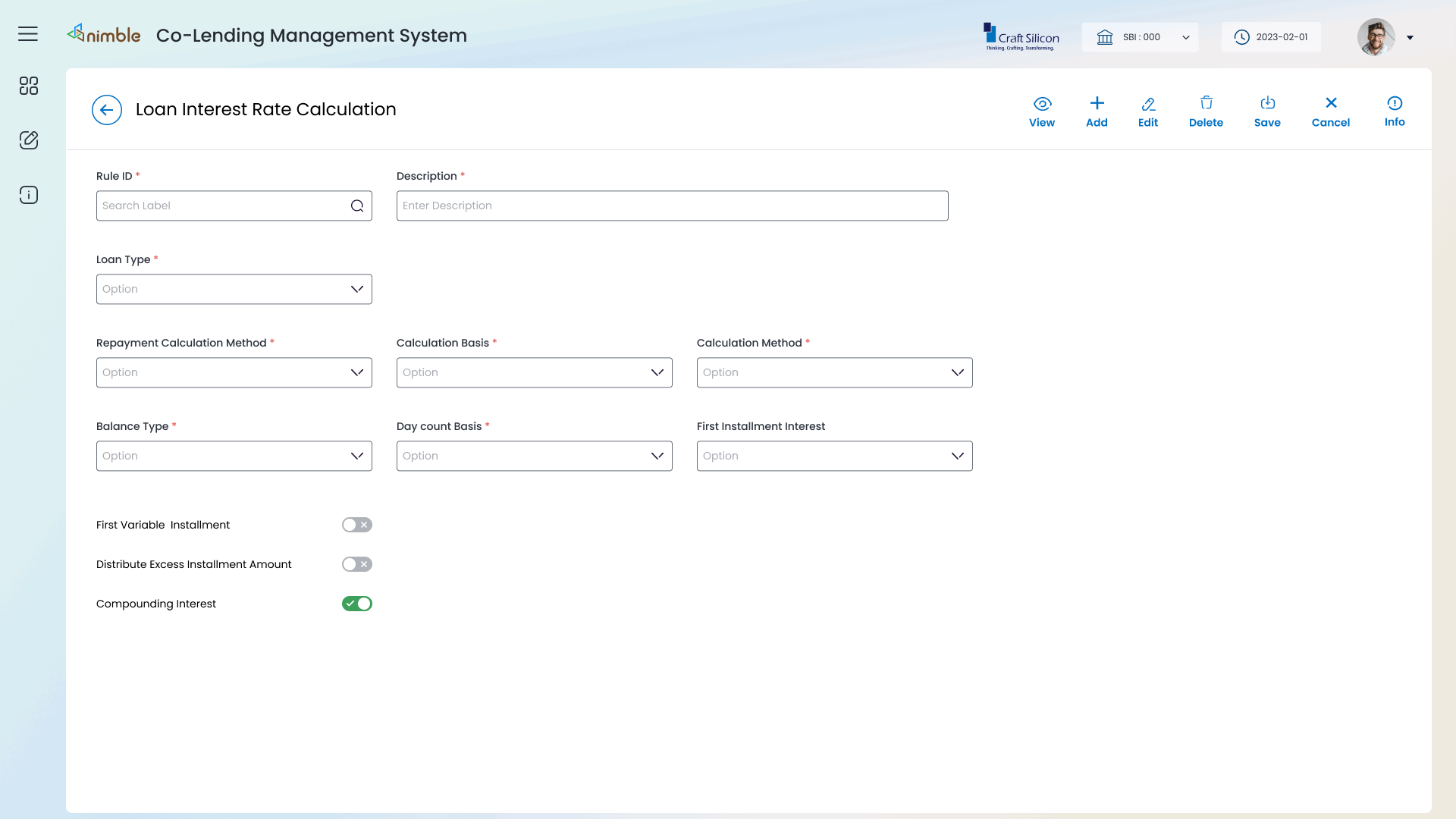

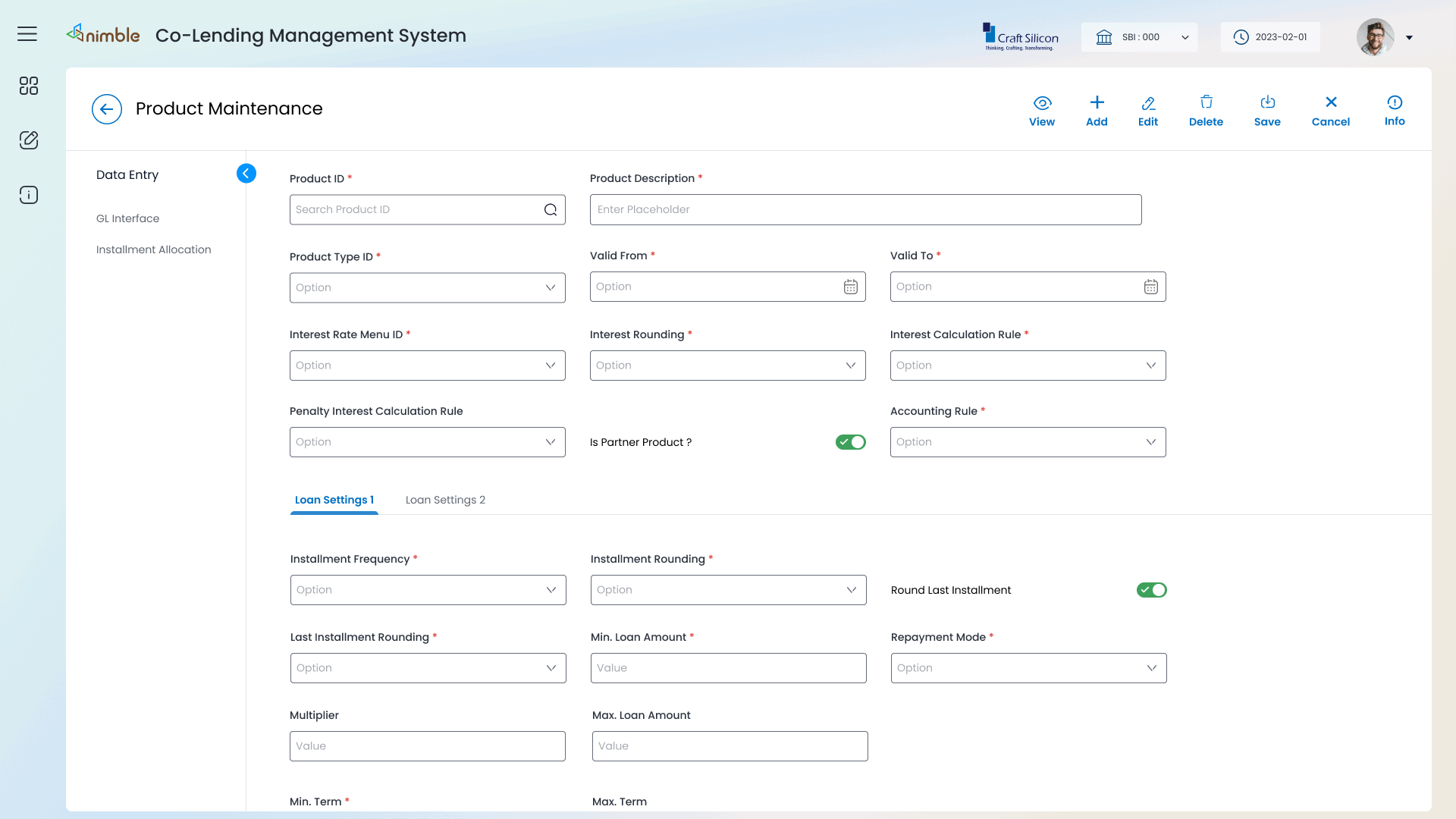

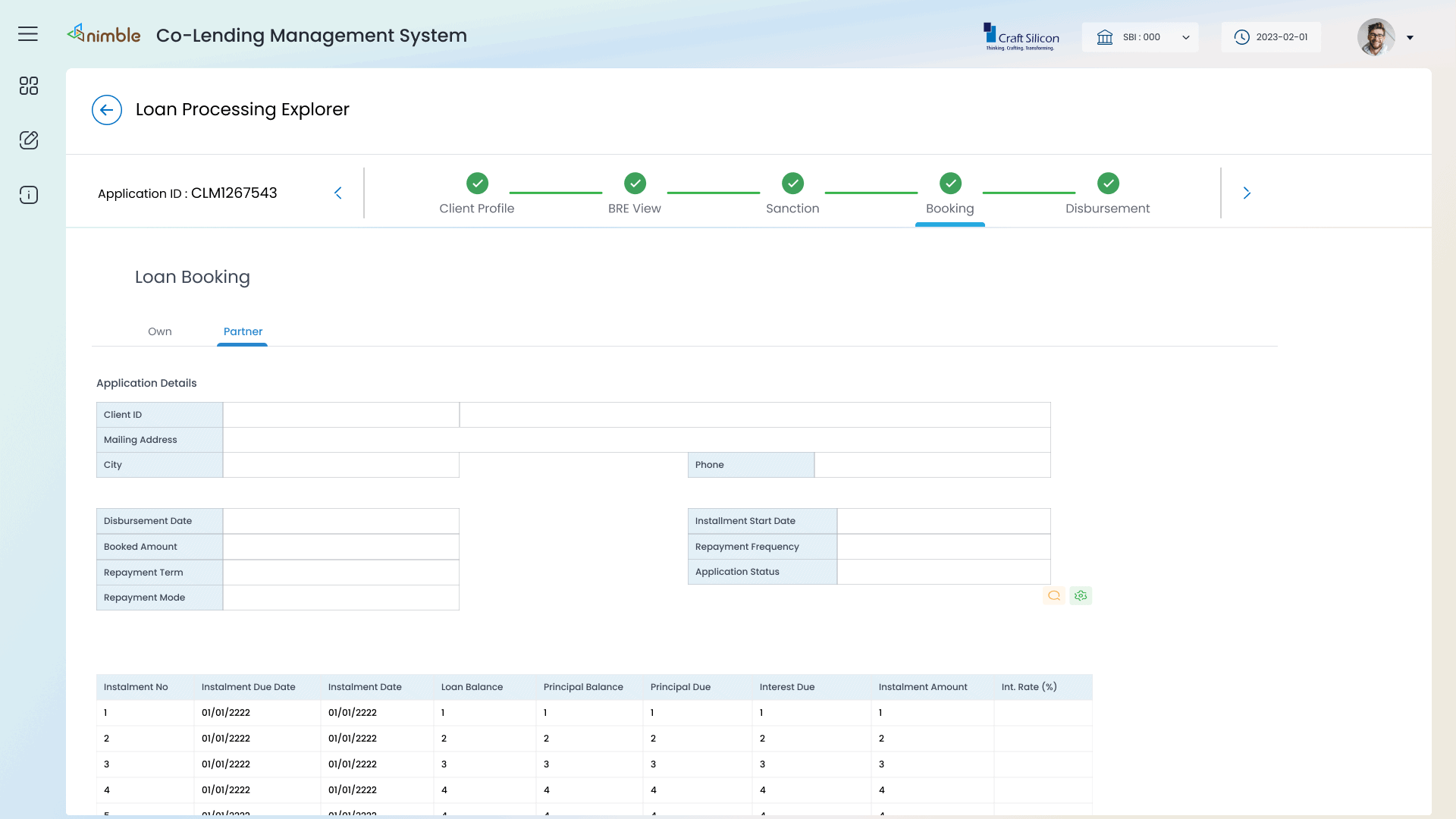

Independent system to handle the co-lending process, from sourcing to disbursement and loan servicing.

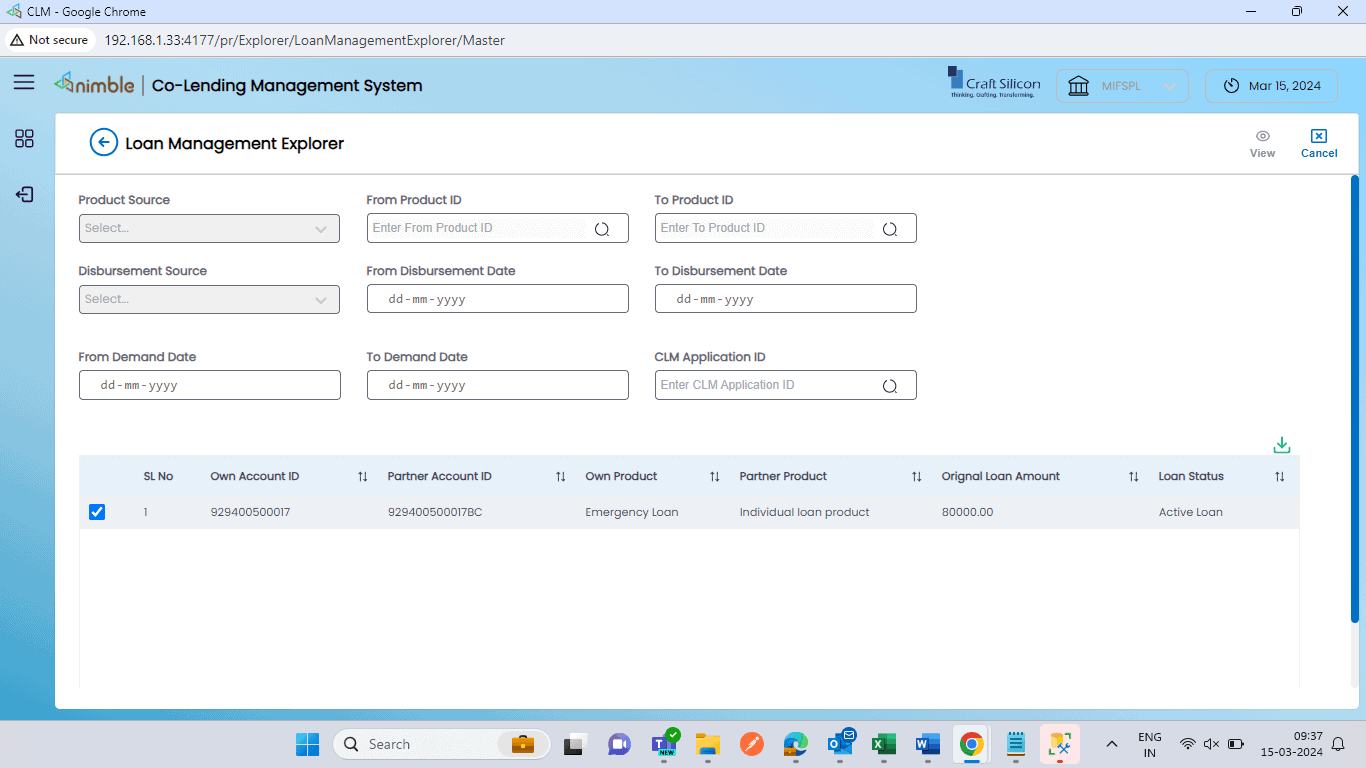

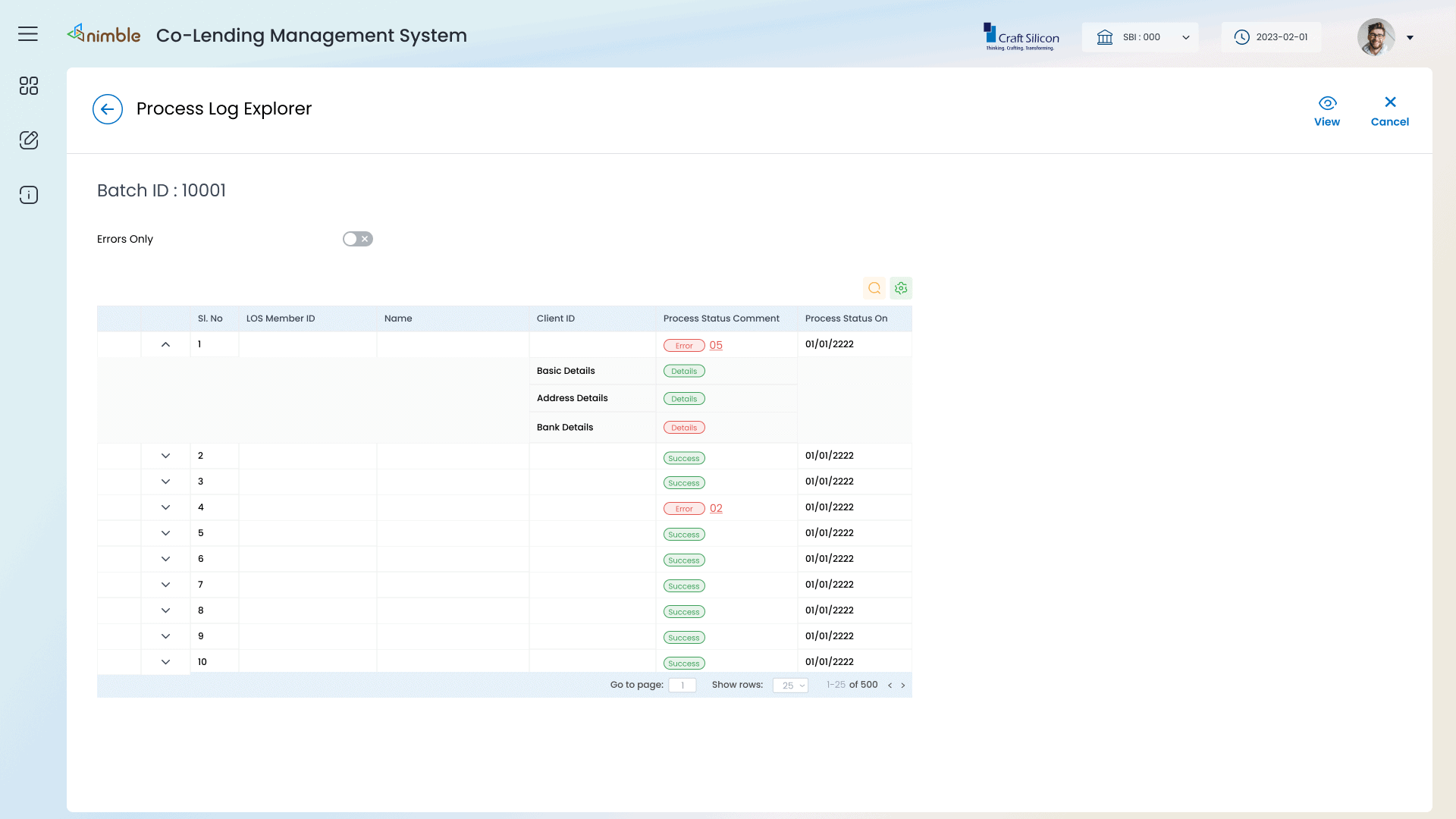

Collaborate data from different source system and manage loan application efficiently.

CB decision, credit underwriting and specific business rule for efficient assessment of loan application.

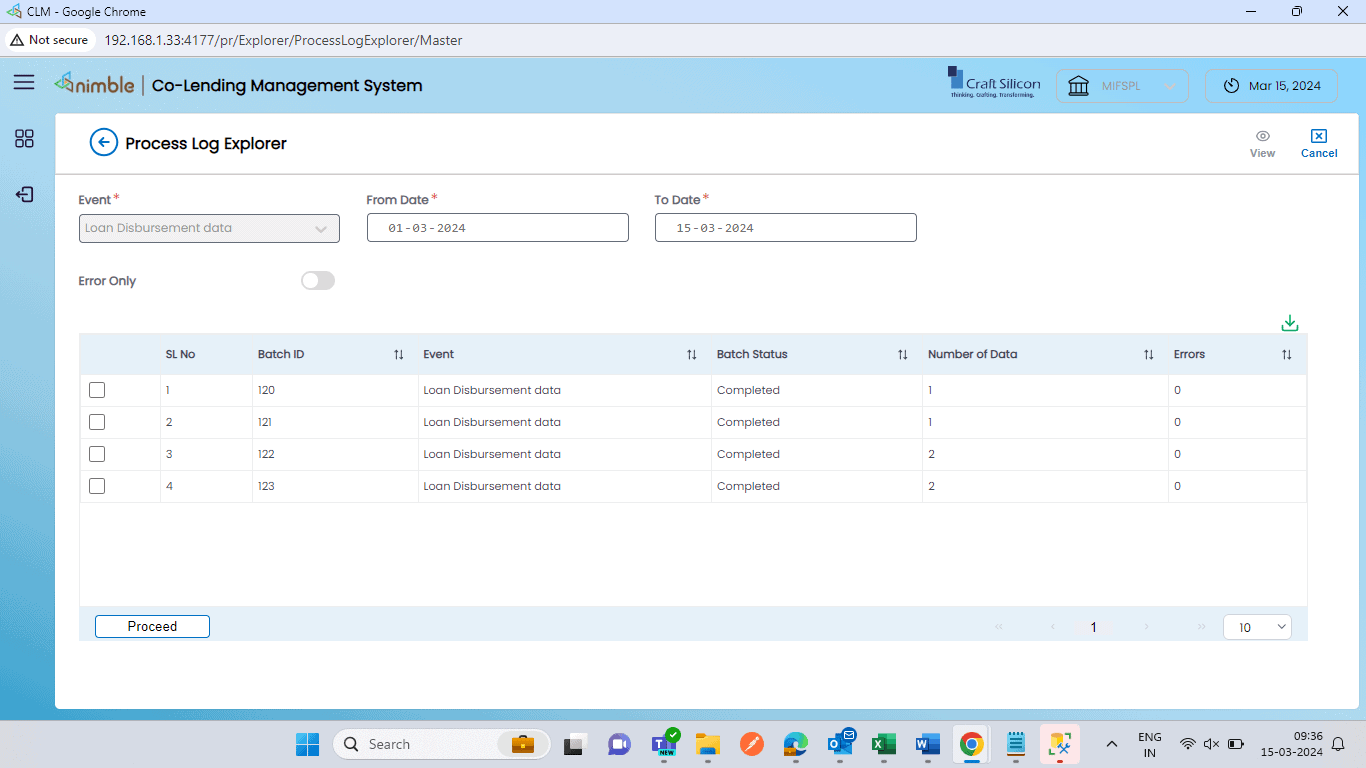

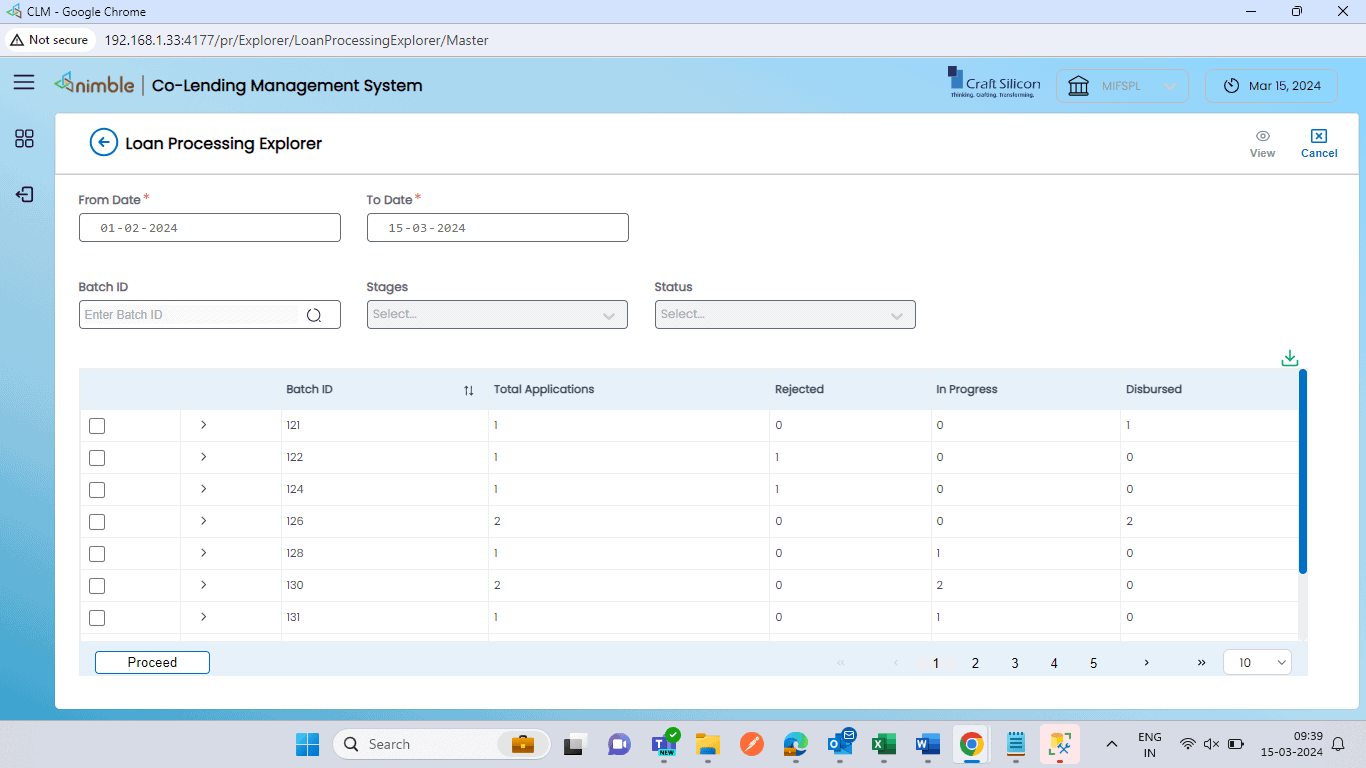

Enable disbursement and collection tracking and reporting, categorized by banks and NBFCs.

Facilitate data exchange between various stake holders in the co-lending process.

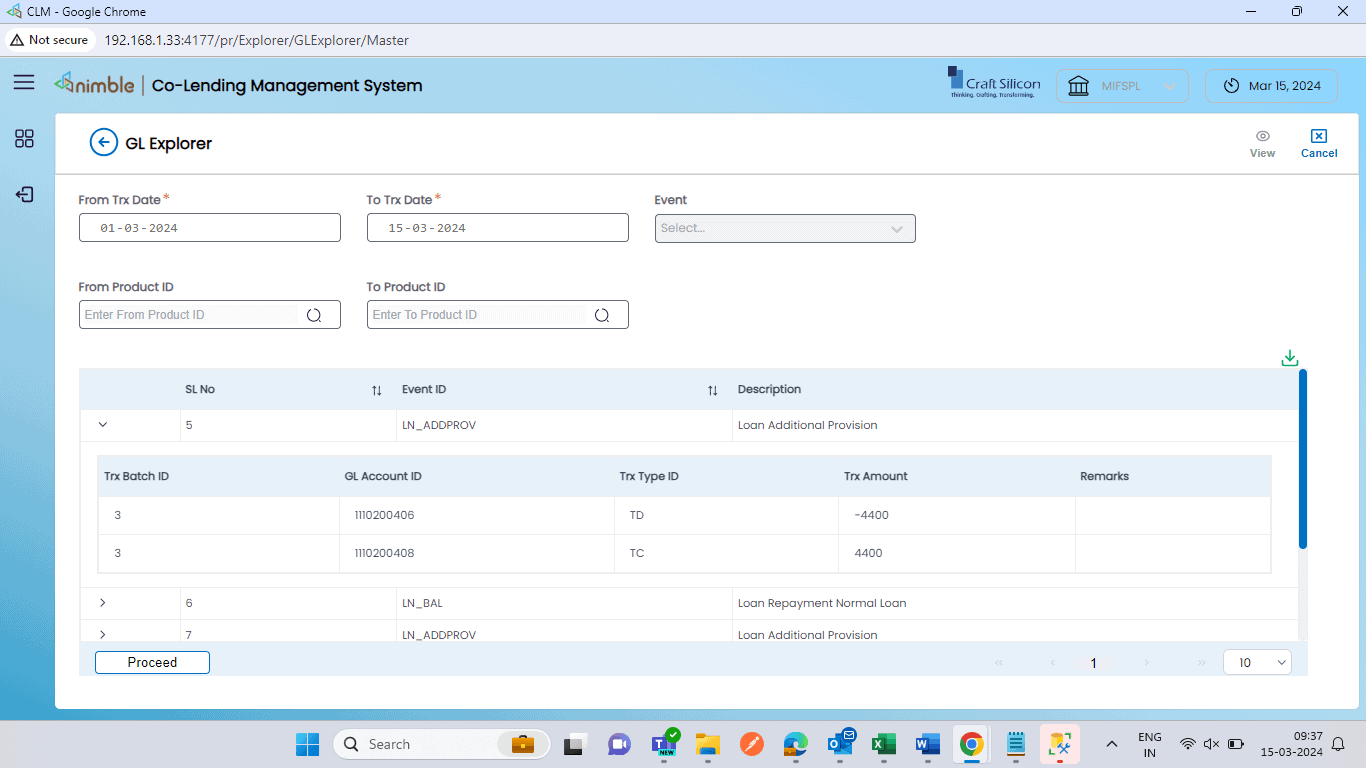

Transactions to manage own & partner portfolio balance in financial statement.

Independent System to handle the Co-Lending Process, from Application to Disbursement and Collection.

Collaborate data from different Source System and manage Loan application efficiently.

CB Decision, Credit Underwriting and Specific Business Rule for efficient assessment of Loan Application.

Enable disbursement and collection tracking and reporting, categorized by banks and NBFCs.

Facilitate data exchange between various stake holders in the Co-Lending process.

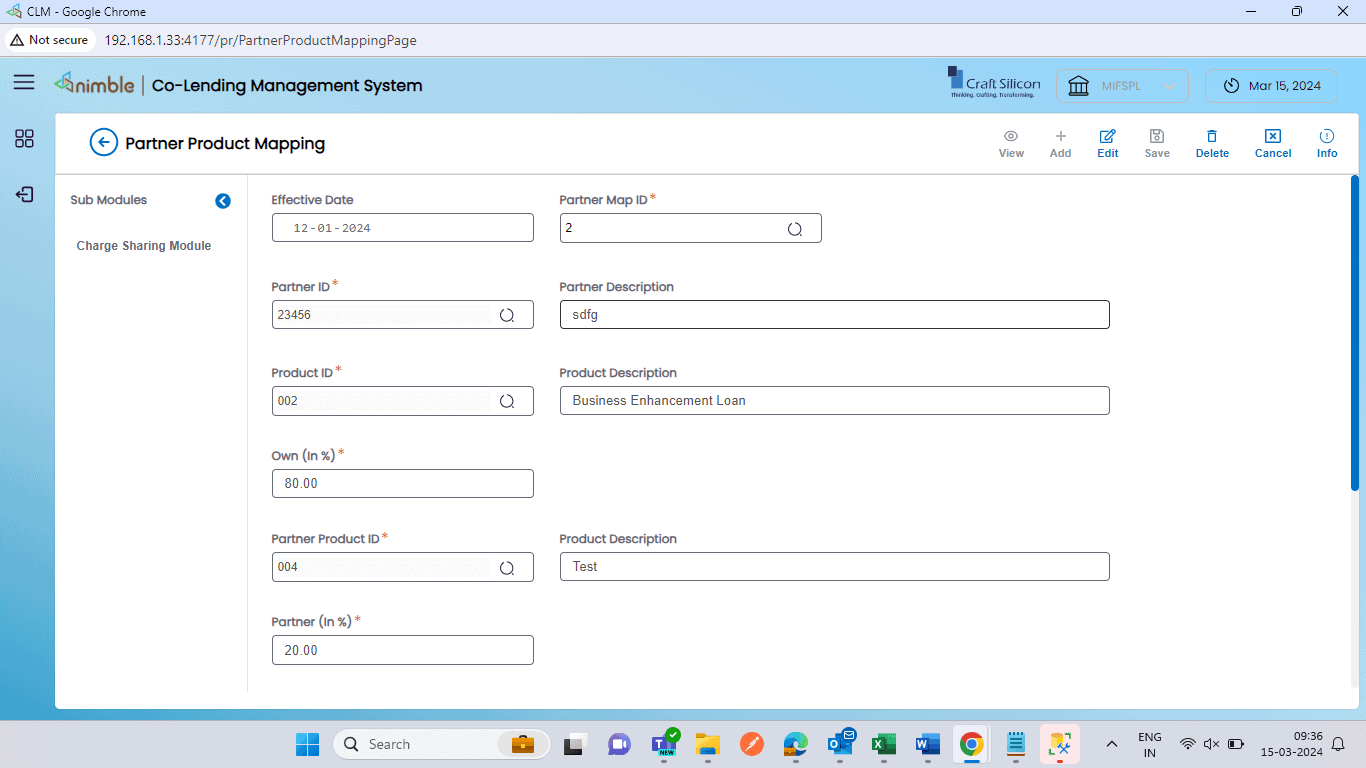

Transaction to manage Partner Portfolio balance to negate 100% portfolio.

key benefits

Drive your lending institutions success story with the right technology

Dynamic view of loan repayment schedule ( Bank, NBFC and customer schedules)

Automated disbursement and collection split with accounting entries.

API and FTP based integrations to support real-time transactions.

Support for both CLM1 and CLM2 models.

Manage multiple co-lending partnerships in single solution.

Dynamic reporting capabilities.

BR.Net is an agile, componentized business solution, addressing the needs of:

- Banks,

- SFBs,

- NBFCs and

- MFIs

It works on a robust technology architecture that supports both SaaS & Modern Enterprise Platform. It drives centralized operations, Supports low-end PCs and mobile phones.

The enterprise-class security ensures seamless integration across industry applications and services.

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.

Client Speak

Martin Pampilly

Chief Operating Officer,

Ujjivan Small Finance Bank

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.