Omnichannel Banking solution creates a virtual bank that offers seamless, consistent, and safe interaction with customers across touchpoints, even smartwatches and smart TVs.

Enhance customer engagement through an omnichannel approach –

- Works on multiple smart devices such as mobile phones, tablets, laptops/PCs, smartwatches and smart TVs

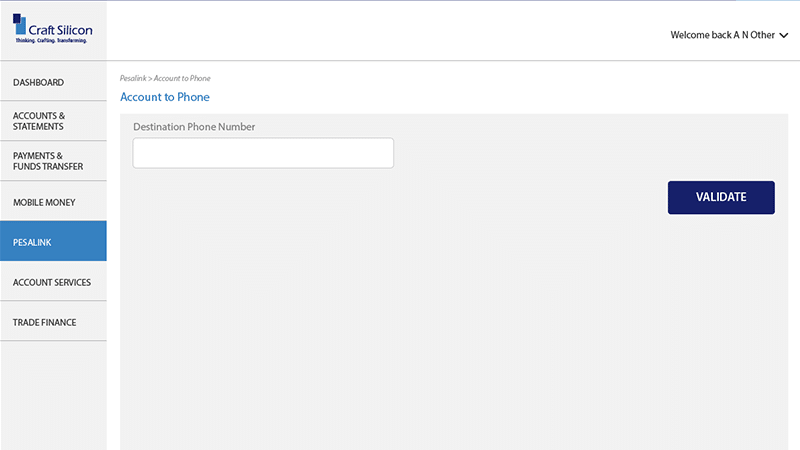

- Access diverse value-added services offered by third-parties like Mobile Network Operators (MNO), utility providers, social platforms and merchants

- Service institutional customers in domains like bulk payments, salary processing, limits & mandates, payroll and reports

KEY FEATURES

key benefits

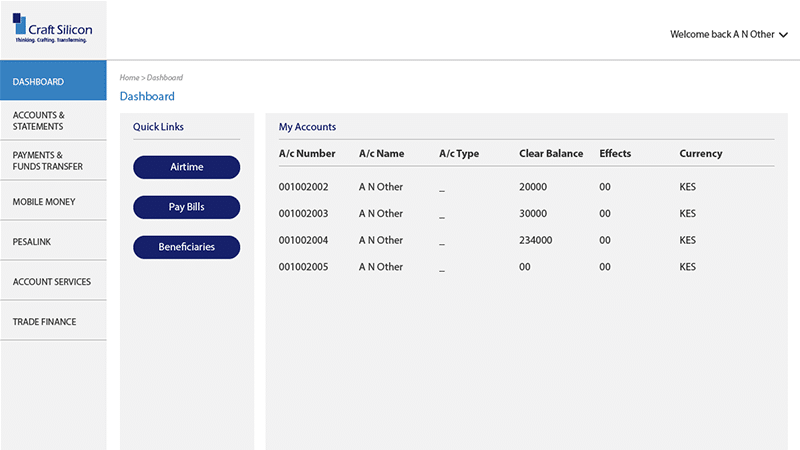

Banking made possible across every channel

Enables access to financial services on mobile, desktops, laptops and other devices.

Robust middleware architecture designed to interface with many channels, third-parties & other software.

Speedy remote customer onboarding and virtual account opening process

Allows easy remote funding of accounts through mobile wallets

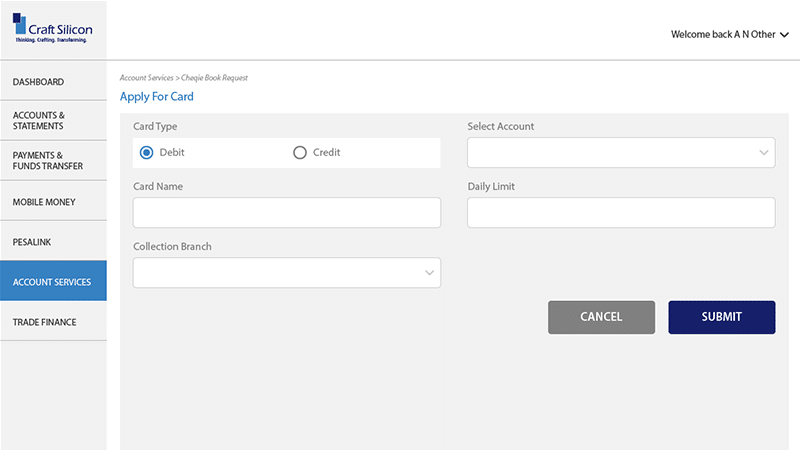

Customers can apply for a loan and trade finance applications to be instantly disbursed to their account

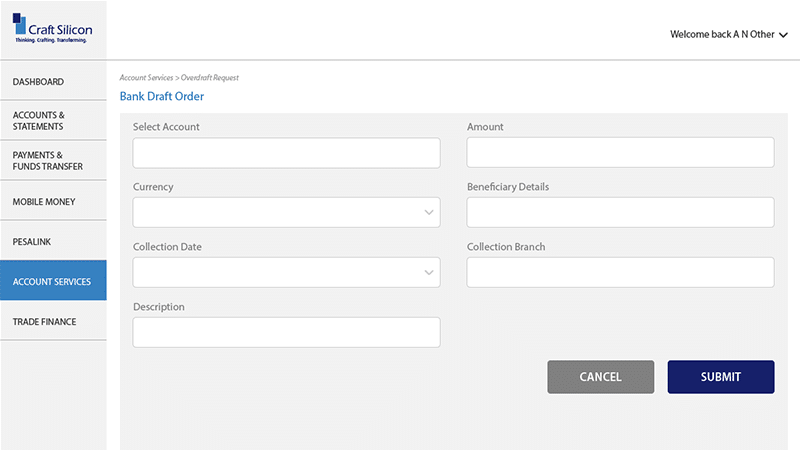

Easy process of bulk payments

Manage and limit access to other users

Real-time support via chat

clients

Case Study

The objective was to streamline digital channels into a single secure experience, enable customers to open accounts instantly, and reduce the pressure on branches to service customers.

Client Speak

testimonials

For more than 5 years, Paramount Bank has worked with Craft Silicon to implement the most innovative ways to help with the banks day to day running and to help with efficient and effective ways for our customers to bank digitally. With this Craft Silicon has provided a full suite web based core banking system and channels system to cater for both retail and corporate customers. We are satisfied with the continued support accorded by Craft Silicon to ensure smooth business operations.